Being an Autónomo in Spain in 2024: Understanding the Freelance Quota

Eager to unveil the mystery behind your freelance quota? Confused about what steps to take? Wondering how it’ll impact your life? 😱

If you’re pondering these questions because you’re already a freelance pro or gearing up to embark on a freelance adventure in Spain, you’re in the right place. In this article, we’ll unravel the enigma of your freelance quota.

What Is the Freelance Quota

The freelance quota is the amount that autónomos or freelancers pay monthly for Social Security contributions in Spain, depending on how long you’ve been developing the activity and registered as an autónomo in the RETA (Special Regime for Freelancers in Spain).

But what is the purpose of the freelance quota? Where does that money go?

The freelance quota guarantees your coverage by Social Security in situations such as healthcare, maternity or paternity leave, or temporary disability.

Two factors are taken into account to define it:

- Base de cotización or contribution base that you have chosen or the law imposes on you based on your age (after 48 years old, you don’t have the same contribution base options).

- Bonificaciones or the bonuses that you may be eligible for (for example, the flat rate for new autónomos).

The base de cotización would be like the salary you receive each month but as a company. Although we already know that this can vary from month to month, it is necessary to have a reference to define:

- The freelance quota that you will have to pay because you will pay more quota each month if the base de cotización is higher.

- The benefits that you may receive in situations such as ceasing activity, sick leave, accident leave, and retirement.

How Is the Freelance Quota Calculated?

From January 1, 2023, the freelance quota is calculated based on net income.

This means the quota will be calculated based on what you earn. Therefore, it won’t increase because of how long you’ve been freelance in Spain, as before.

15 contribution tranches have been created that you have to choose from based on your income.

Contribution or Cuotas Based on Actual Income

As mentioned, the new system considers the net income to calculate the quota.

And you will ask yourself: “And how do I calculate my real income?.”

The easiest (and most correct) way to do this is using the following formula:

{Income – expenses – [7% (income-expenses)] + Freelance Quota} * 0,93

For example, imagine that you are an autónomo who in 2022 earned €25,000 gross in income from their work, had expenses of 3,000, and paid an €80 monthly freelance quota because you’re a new autónomo.

The result would be:

{25,000 – 3,000 – [7% (25,000 – 3,000)] + (80*12)} * 0.93=18,953.4 in annual income.

Important Questions

This is clear: the quota is calculated proportionally to your actual income. But now we’ll answer the questions that surely are on your mind.

🤔 How much do I have to pay for the quota?

It depends on the bracket you choose. You can see the corresponding quotas for each frame in 2023 until 2025 in this table:

| Income | 2023 | 2024 | 2025 |

| Quota | |||

| <€670 | €230 | €225 | €200 |

| €670 – €900 | €265 | €250 | €220 |

| €900 – €1166.70 | €275 | €267 | €260 |

| €1166.70 – €1300 | €291 | €291 | €291 |

| €1300 – €1500 | €294 | €294 | €294 |

| €1500 – €1700 | €294 | €294 | €294 |

| €1700 – €1850 | €310 | €320 | €350 |

| €1850 – €2030 | €315 | €325 | €370 |

| €2030 – €2330 | €320 | €330 | €390 |

| €2330 – €2760 | €330 | €340 | €415 |

| €2760 – €3190 | €350 | €360 | €440 |

| €3190 – €3620 | €370 | €380 | €465 |

| €3620 – €4050 | €390 | €400 | €490 |

| €4050 – €6000 | €420 | €445 | €530 |

| €6000 | €500 | €530 | €590 |

In the following years, the minimum quota will be progressively reduced, and the maximum will increase so that in 2024 the minimum will be €225. In 2025, it will be €200. As for the maximum, in 2024, it will be €530, and in 2025 it will be €590.

🤔 What happens if I have chosen a frame, but my income is lower or higher than expected?

You can regulate it at the end of the year, so if you have paid too much, you’ll receive a refund, and if you have paid too little, you will have to pay the corresponding amount.

🤔 What happens if I previously chose a higher base de cotización to have more rights to benefits, pensions, etc.?

No problem, you can stay with that base. Still, once the contributions are regulated at the end of the year, you will have to renounce the refund of the quotas

🤔 Can I change my frame?

Yes, you can change it every 2 months and up to 6 times a year.

Entrepreneurial Societies in 2024

Entrepreneurial societies will have a minimum contribution base of €1,000 per month.

This means the quota will be €310 per month instead of the €377.87 they had to pay in 2022. This represents a savings of 814.44 € per year. Not bad, right?

But it’s important to keep in mind that if the income is higher, the monthly quotas will be higher than those in 2022.

And as for the deduction for generic expenses, as we mentioned before, for entrepreneurial societies is 3% instead of 7%.

What Happens if It’s Your First Year as an Autónomo in Spain?

The freelance quota for new autónomos becomes €80 for the first 12 months of activity, regardless of income. And in the following 12 months, the autónomo can continue to pay the €80 monthly quota as long as their income is below the SMI (minimum wage).

Although the quota is higher than in previous years, it has the advantage that it can be extended if the income is below the minimum wage. It can be extended up to 36 months, depending on the Comunidad Autónoma.

Steps to Follow to Communicate Your Income

If you request a change in the base de cotización, you must follow these steps:

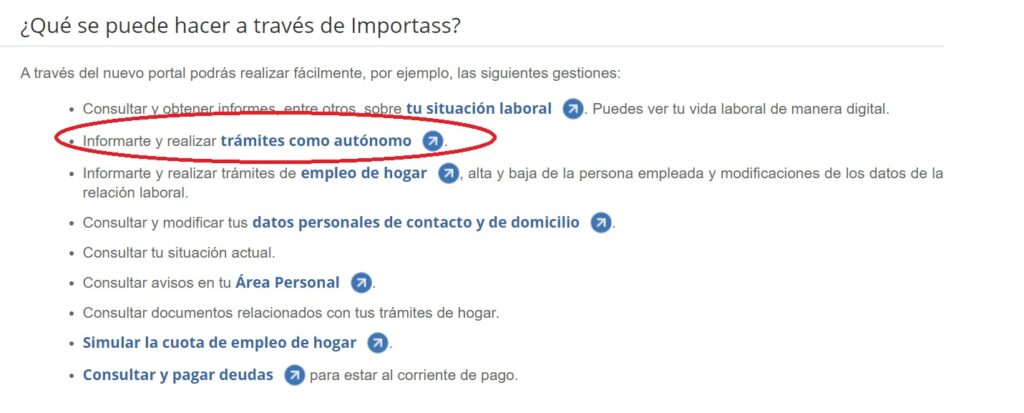

1. Access the Import@ss platform from the TGSS (Treasury General of Social Security). Click where it says, ”Informarte y realizar trámites como autónomo.” It will take you to this website.

2. Click on the box that says “Base de cotización y rendimientos”.

3. Click on “Solicitar modificación” (request modification).

4. Login with cl@ve permanente, cl@ve PIN, via SMS o electronic DNI or certificate. The fastest way is via SMS.

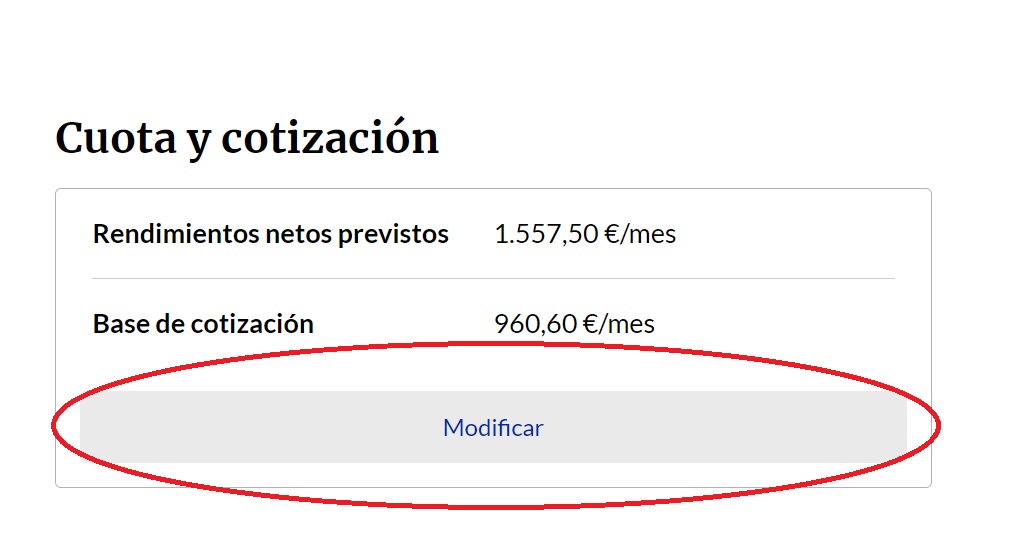

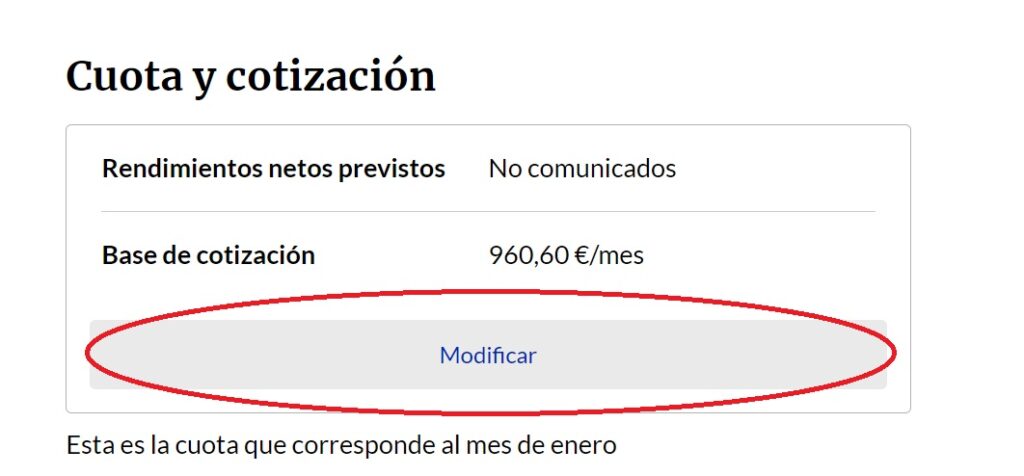

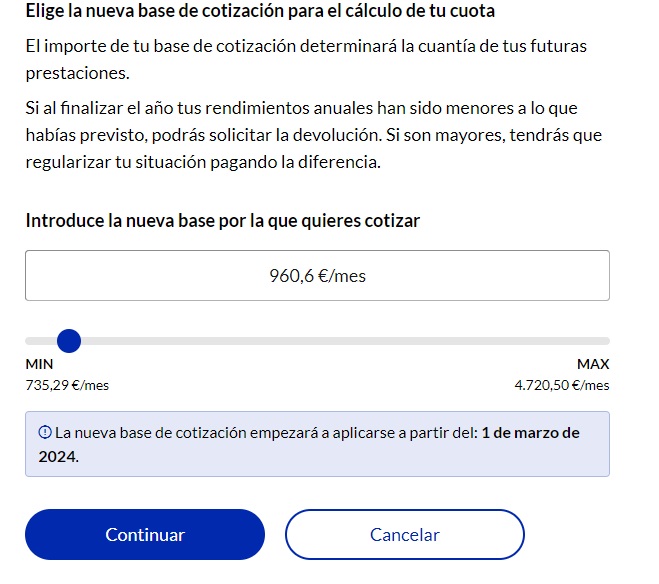

5. Click on the “Cuota y cotización” (“Quota and contribution”) section and select “Modicar” (change).

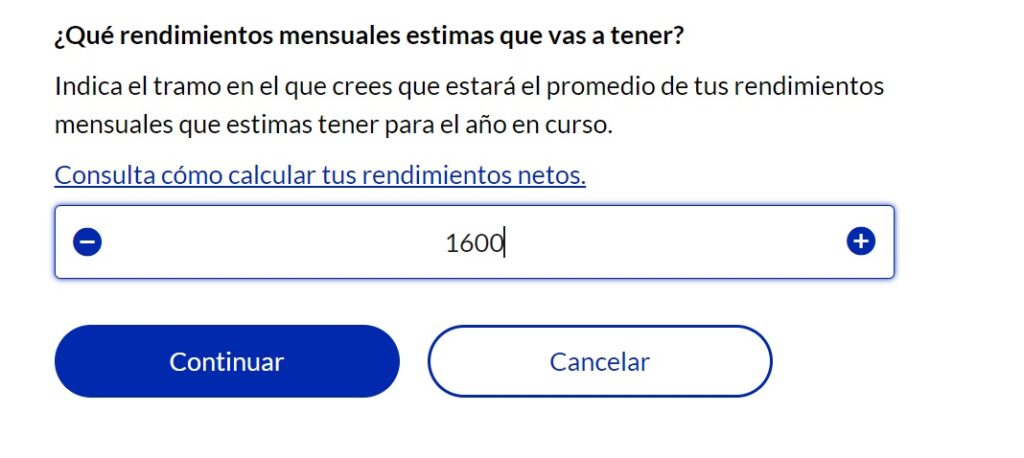

6. Now, you can write the net income you have calculated.

7. Your base de cotización will be calculated automatically, but it allows you to change it if you want to.

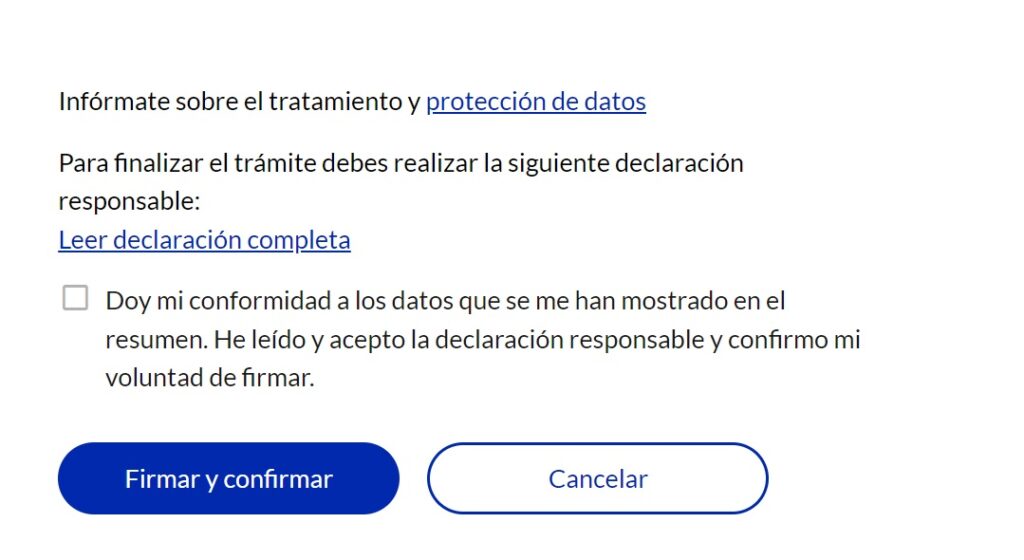

8. You will see a summary of your data and the changes applied. Review them carefully, and if they are correct, select “Doy mi conformidad…” and click on the button “Firmar y continuar” (Sign and continue).

If you want to modify them, you can click on “Modificar.”

Is it a “fairer” quota than before?

The intention of this change is supposed to be that the quotas are fairer for the freelancers and according to the real income.

However, except for the new autónomos, the truth is that the fees are still high for freelancers with lower incomes.

Anyway, we hope that with this article, you will clearly understand the freelance quota to be paid in the year 2024 if you are an autónomo or freelance in Spain or if you are considering it.

Regardless of your situation, at Companio One Spain, we help you manage your invoices and tax declaration so you save time. You can focus on what is essential: your business and your clients.

Click here to learn more.